This blog is based on our event: Beyond Budgeting – Business agility in practice. The Handelsbanken case story, led by Bjarte Bogsnes, Chair of the Beyond Budgeting Round Table.

“The budget is, in the best case, totally unnecessary, and in the worst case, actively harmful”, Former Handelsbanken CEO, Jan Wallander

What do you think of when you hear the word ‘budget’? Something strict and inflexible – something that you MUST stick to if you are to succeed? In its adjectival form, ‘budget’ means ‘inexpensive’— a budget holiday for example.

But what is the true cost of putting traditional organisational budgeting processes on a pedestal?

The Beyond Budgeting Approach

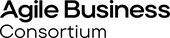

The Beyond Budgeting approach is the idea of abolishing such processes to make businesses more agile and improve performance.

In this member-only event, Bjarte Bogsnes, Chair of global network the Beyond Budgeting Round Table, explains why traditional budgeting can be counterproductive for businesses.

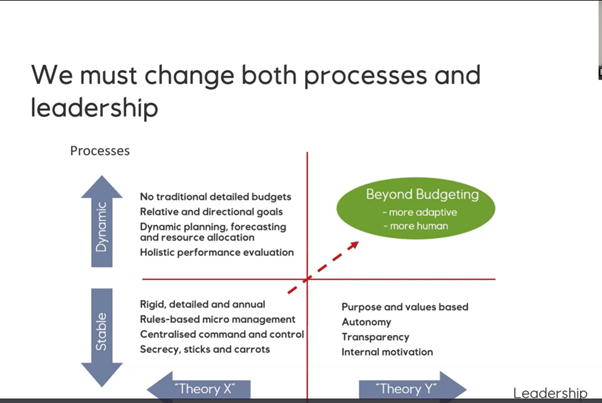

He shares the 12 principles of the Beyond Budgeting framework, developed to help make creating realistic, effective, and focused budgets easier, and highlights the phenomenal success story of business agility legend Handelsbanken.

So what is wrong with businesses budgeting the way they always have done?

Bjarte explains: “Every time I talk about Beyond Budgeting, one word keeps coming up: ‘control’. “When I ask people to define control and ask what it is they fear losing, many go quiet after they’ve said cost control.

“The dictionary defines the word ‘control’ as: ‘The power to influence or direct people’s behaviour or the course of events. And what does this mean in business terms? Controlling people and controlling the future.

“But these are illusions of control: that people can’t be trusted and can and must be managed. That the future is predictable and manageable and you can plan for it.

“The traditional detailed annual budget has to go because it represents so much of those illusions.”

Bjarte adds that budgeting in the traditional way is both very time-consuming and lacking in transparency, stimulating unethical behaviours. He notes that decisions are made too early and often too high-up, preventing value-adding activities. It is also interesting to note, he says, that:

“In many organisations, the budget is not just seen as a ceiling – a way of keeping spending below a certain level, but as a floor - in other words, a view that because the money is there, it has to be spent – wisely or not, or lost.”

He adds: “Hitting the budget numbers is often a bad yardstick for evaluating performance.

“Why on earth should we base everything on the fiscal year from January to December. We need a more holistic performance evaluation—one that is more business and event driven, a richer language.”

So how is it possible to achieve good company performance without a budget, as we know it?

Beyond Budgeting Principles

Below are the 12 Beyond Budgeting principles – recommendations of things to do and things to avoid when it comes to managing and leading.

Bjarte is keen to stress however that this framework should not be seen as a ‘management recipe’:

“I don’t like management recipes, as that means someone has done all the thinking for you and you need to think what this means for you.”

To continue reading about the Handelsbanken story please become a member.

Join Beyond Budgeting Institute’s Managing Director Rikard Olsson at the Agile Business Awards, March 22nd to 23rd, where he will be part of our Agility in Finance panel.

The Awards are designed to shine a light on good practices across the whole spectrum of business agility.

Please note blogs reflect the opinions of their authors and do not necessarily reflect the recommendations or guidance of the Agile Business Consortium.